Explain Different Techniques of Capital Budgeting

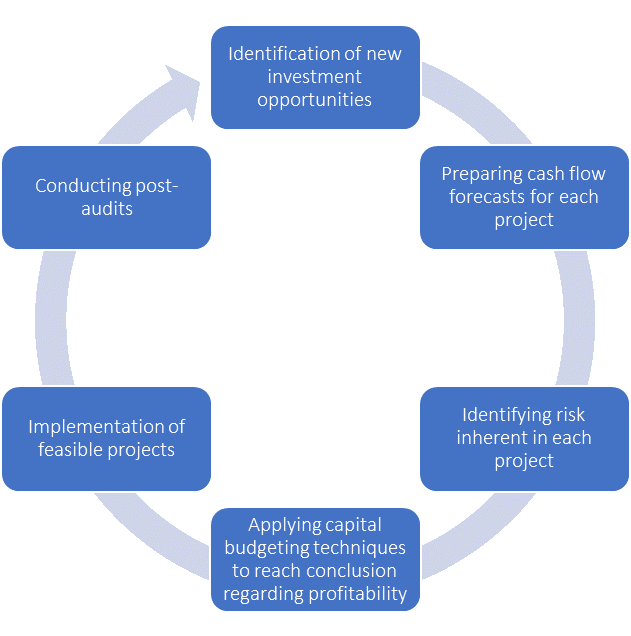

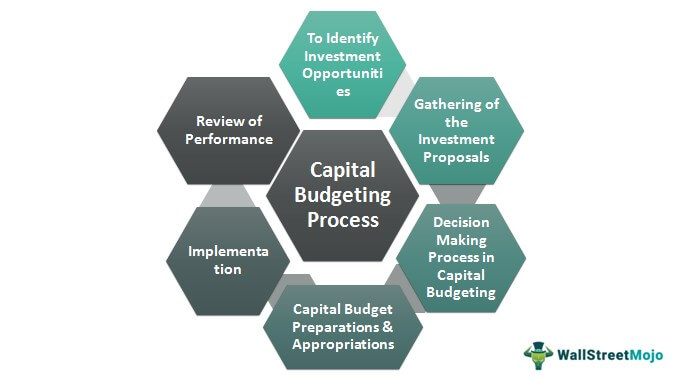

Steps which are taken to control the capital budgeting process are as follows-1 Indentify the proposals which are already involved in capital budgeting. Cost accounting methods 4.

What Are Capital Budgeting Techniques Definition And Meaning Business Jargons

Weve a summary and quick links on how to get started if you already know the basics.

. Sanjay Borad is the founder CEO of eFinanceManagement. Henry Fayol considers coordination as a function of Manager. Several techniques are commonly used as part of financial statement analysis.

Allen also regards coordination as one of the separate managerial functions. Davis looks upon coordination primarily as a vital phase. April 13 2022 Post navigation.

Our Budget Planner spreadsheet is based on rock-solid budgeting theory accurately mapping your incomings and outgoings over a year then helping assess whether it balances. Alternatively read the full guide below for detailed help. Accounting for material labour and overheads 2.

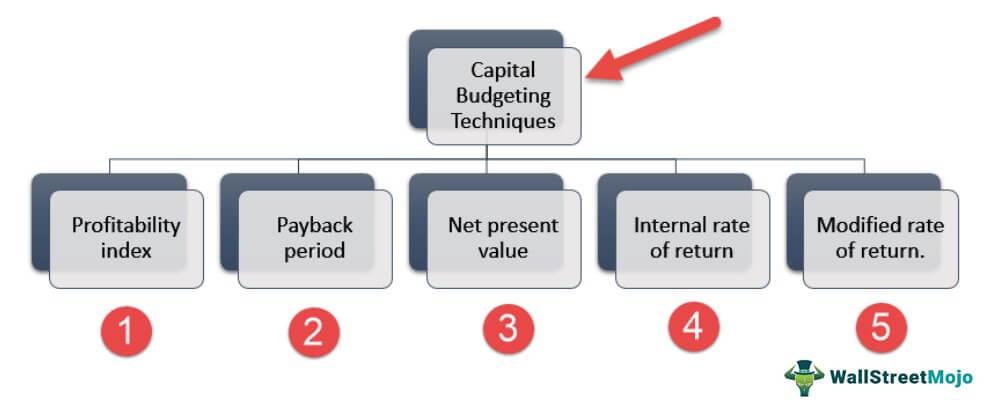

Three of the most important techniques include horizontal analysis vertical analysis and ratio analysis. The main objective is to maximize shareholders wealth with a. This budgeting starts from a zero base and every.

One assignment at a time we will help make your academic journey smoother. Coordination has been viewed by different management experts in different ways. 2 Do the screening of the proposal for future estimation.

Various Avenues and Investments Alternative. C Cost accounting techniques. Gather statements and receipts.

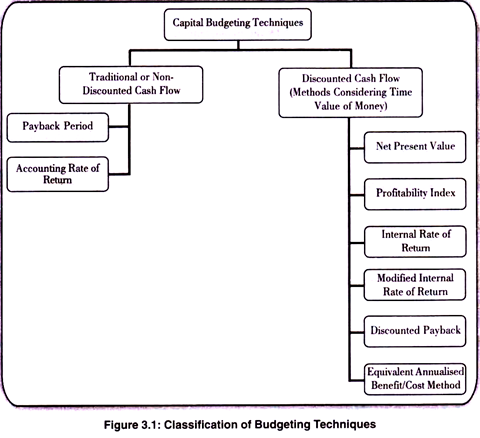

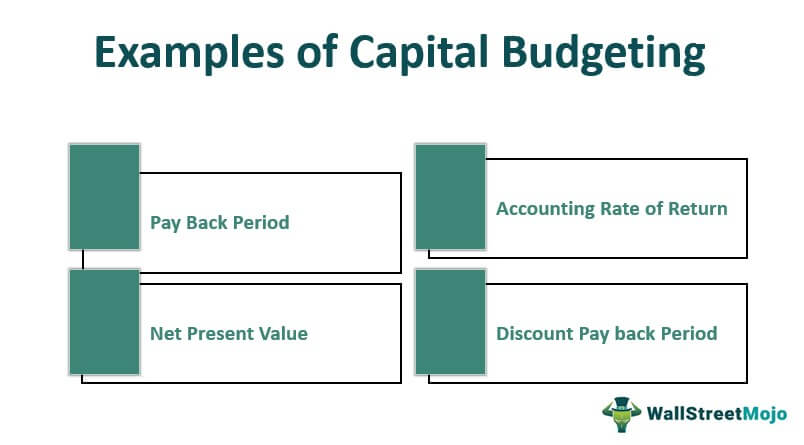

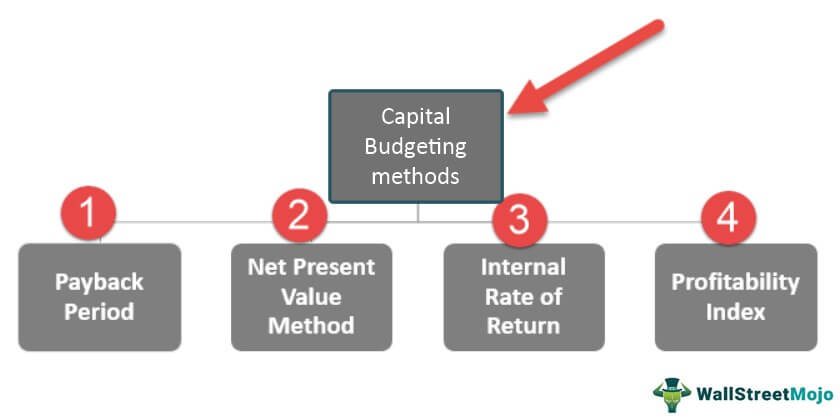

Investment appraisal techniques are also known as capital budgeting techniques. In this method all the business activities are assessed every time the budget is prepared. Finance is then often divided into the following broad categories.

Process of Capital Budgeting Last Updated on. Current budgets are prepared for the current operations of the business. Alternative cost accounting principles D Budgeting 1.

To assist Tourism Australia in preparing technology capital budget for 2005. Because capital budgeting decisions impact cash flows for multiple years time value of money concepts are used including present value of one calculations and present value of. Finance is a term for the management creation and study of money and investments.

This budget is developed without making any reference to the base amounts of past budgets. Also it helps a company to choose the best project when it faces a choice between two or more products. The scope of budgeting activity may vary considerably among different organization.

At this stage the financial manager has to evaluate the appropriate mix of debt and equity capital and various short and long-term debt ratios. The planning period of a budget generally in months or weeks. A Explain the nature source and purpose of management information B Explain and analyse data analysis and statistical techniques C Explain and apply cost accounting techniques D Prepare budgets for planning and control E Compare actual costs with.

Absorption and marginal costing 3. The Portfolio Management was used primarily to assist in budgeting process using equivalent of Identification Categorisation Evaluation Selection and Prioritisation processes of the current standard. Nature and purpose of budgeting 2.

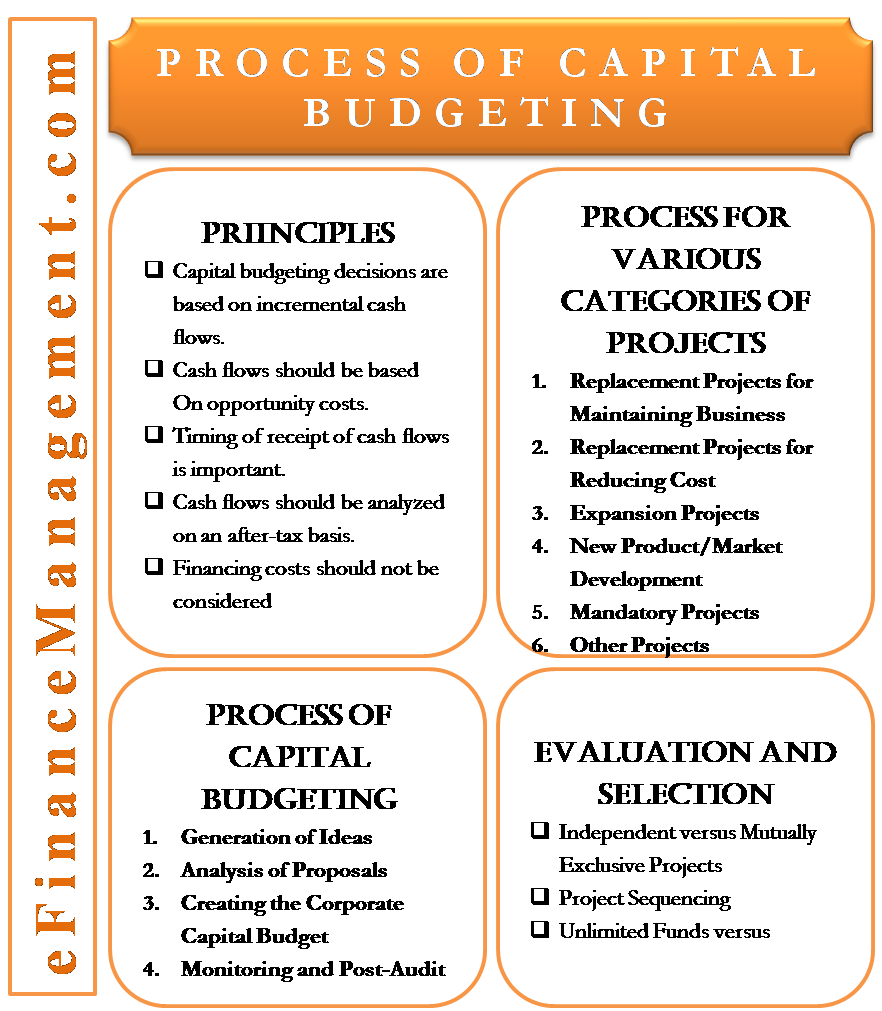

He is passionate about keeping and making things simple and easy. 3 Evaluate the different type of proposals 4 Fix the priorities of the proposals 5 Final approval and planning of the capital. Capital budgeting and discounted cash flow 5.

As per ICMA London Current budget is a budget which is established for use over a short period of time and related to current conditions B. Budgetary control and. Capital budgeting helps an entity decide whether or not a project would offer the expected returns in the long term.

The typical format of a capital budgeting decision often includes a cash out flow a time period zero resulting in cash inflows or reduced outflows due to increase efficiencies over multiple years. Running this blog since 2009 and trying to explain Financial Management. Zero-Based Budgeting Zero-based budgeting is a process that requires the formulation of a budget from zero.

Specifically it deals with the questions of how an individual company or government acquires money called capital in the context of a business and how they spend or invest that money. After determining the requirement of capital funds a decision has to be made regarding the type and proportion of different sources of funds. Mooney considers coordination as the first principle of the organization.

/dotdash_Final_An_Introduction_to_Capital_Budgeting_Sep_2020-01-e2feb6a3d3a74e3abd4d2da585c9ef20.jpg)

An Introduction To Capital Budgeting

Capital Budgeting Techniques Importance And Example

Capital Budgeting Process Top 6 Steps In Capital Budgeting Examples

Capital Budgeting In 10 Min Capital Budgeting Techniques Decisions Npv Net Present Value Youtube

Capital Budgeting Techniques List Of Top 5 With Examples

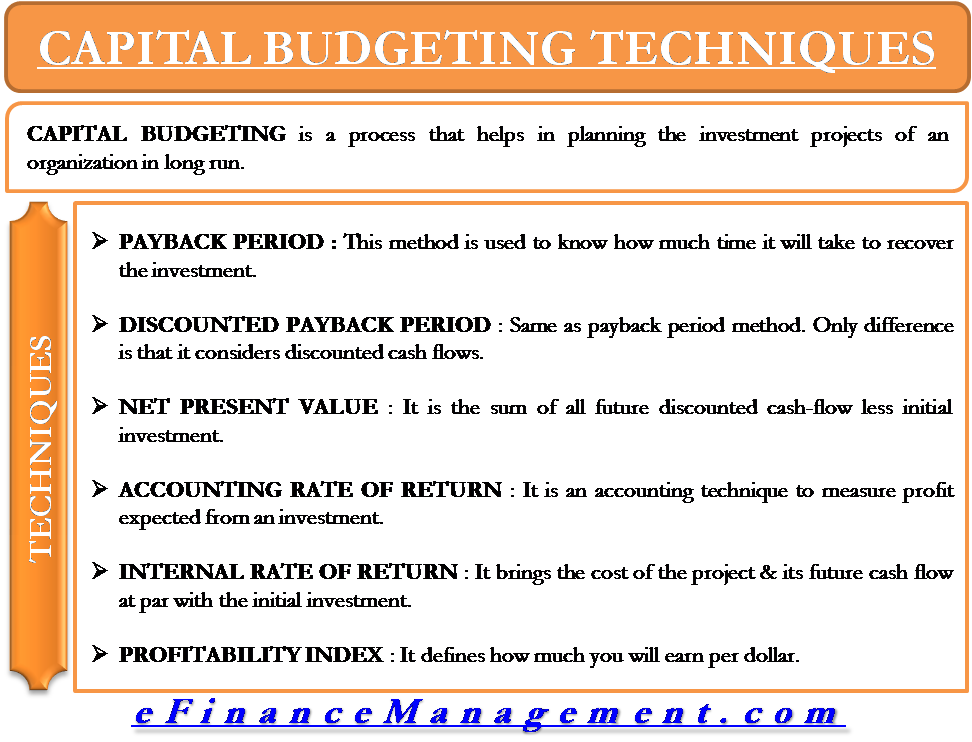

Explain 5 Techniques Of Capital Budgeting Budgeting Process Budgeting Financial Management

Capital Budgeting And Various Techniques Of Capital Budgeting

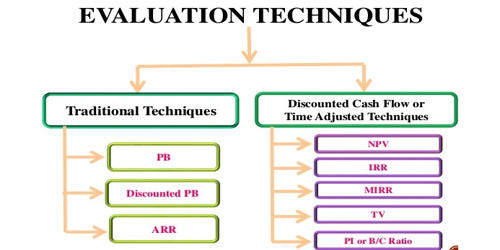

Evaluation Techniques Of Capital Budgeting Assignment Point

3 Techniques Used In Capital Budgeting And Their Advantages Mksh

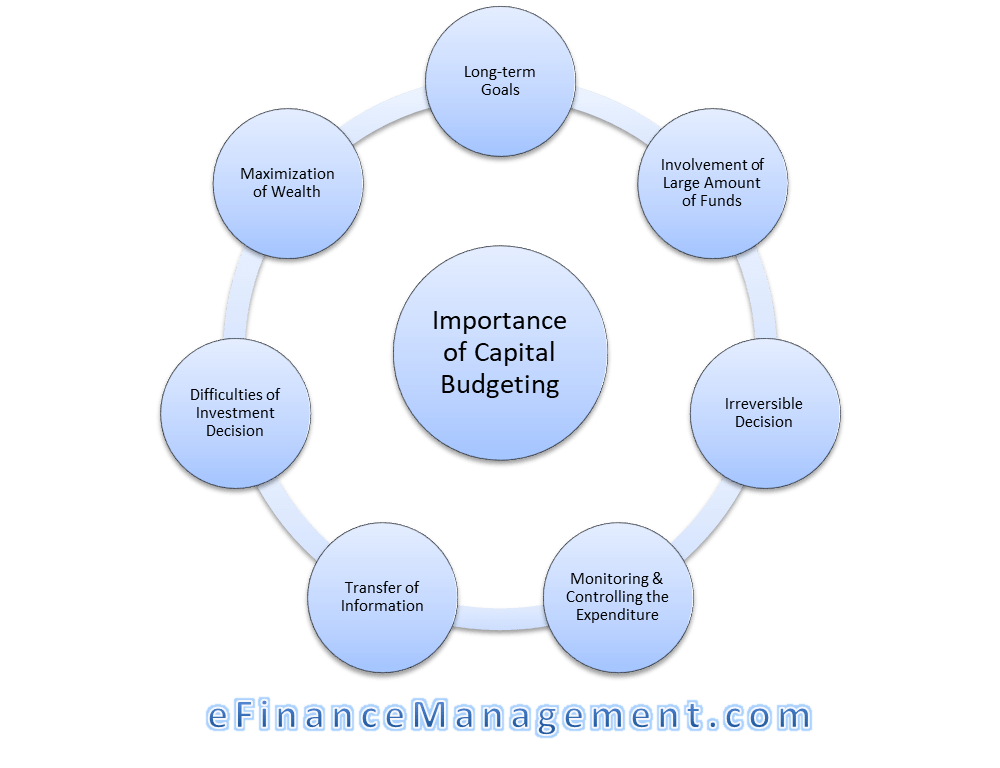

Importance Of Capital Budgeting Meaning Importance

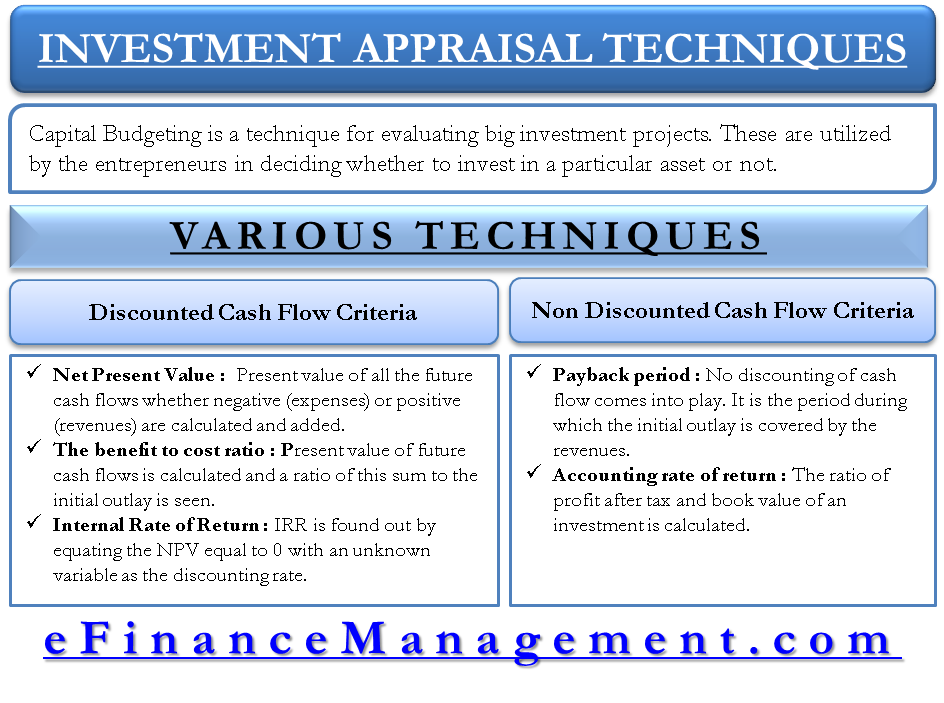

Investment Appraisal Techniques Payback Arr Npv Irr Pi Efm

Capital Budgeting Techniques With An Example Meaning Example

Evaluating Capital Budgeting Decisions 8 Techniques Financial Management

Capital Budgeting Definition Advantages How It Works

Capital Budgeting Examples Top 5 Capital Budgeting Technique Example

Capital Budgeting Methods Overiew Of Top 4 Method Of Capital Budgeting

Comments

Post a Comment